The Public Information Office, a division under the County Manager’s Office, oversees the communications, marketing, and community relations efforts between the County and our citizens. Our goal is to keep citizens connected with frequent and reliable updates on news and information. You’re invited to engage with the County by participating in events, attending community input sessions, providing feedback on county initiatives and programs, and reporting any issues or concerns.

Popular ResourcesView All

Harnett Happenings

Harnett Happenings is Harnett County's online email subscription for citizens. Read more

School Bus Safety Program

School Bus Safety Program With North Carolina's first stop-arm safety program, Harnett County is taking action against dangerous driving around school buses. School buses in the district are equipped with … Read more

Public Records Requests

Harnett County is committed to transparency and upholding the North Carolina public records laws, which include but are not limited to North Carolina General Statute Chapter 132.1 and General Statute 153A-98 … Read more

What's New?View All

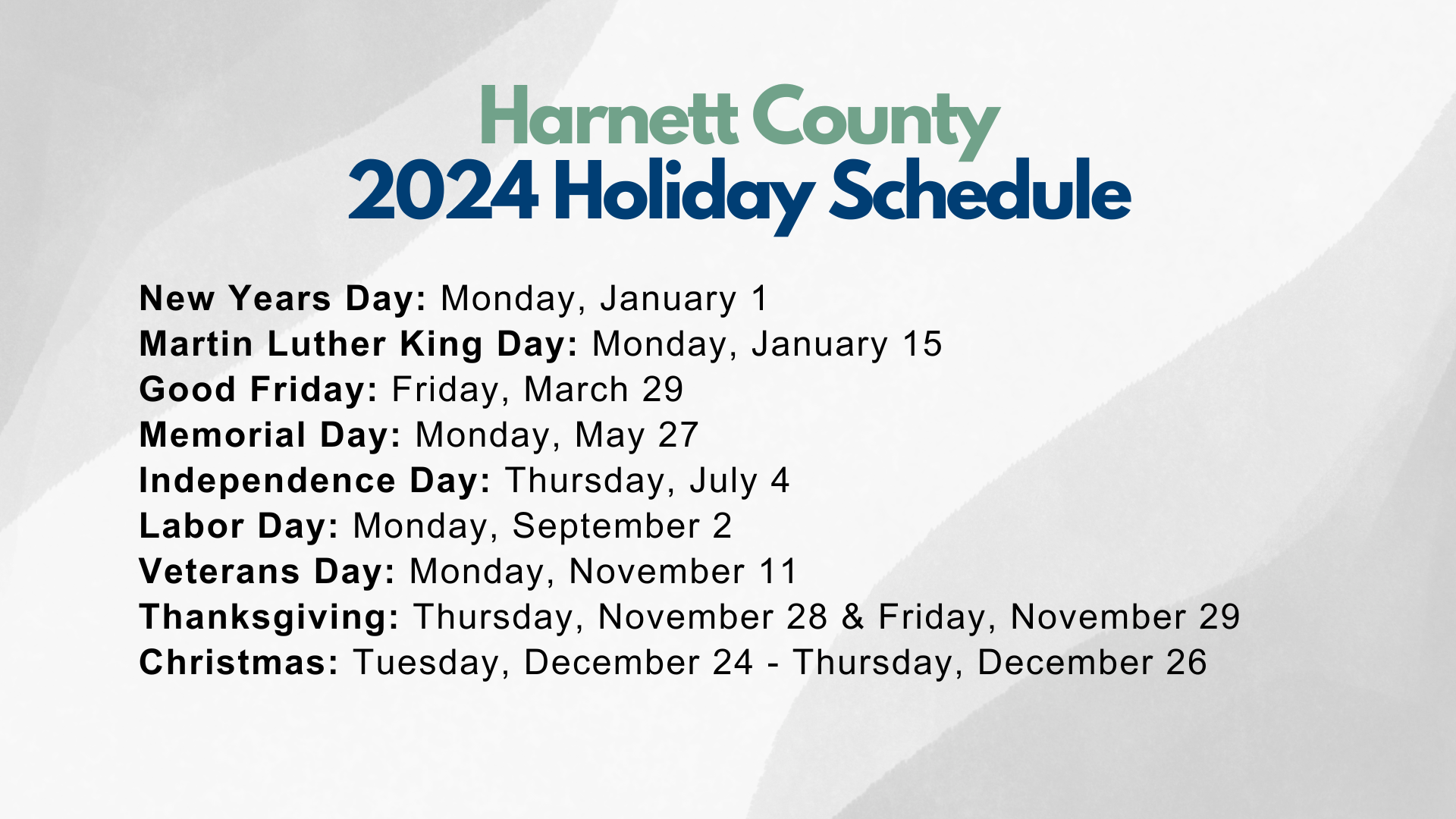

Upcoming Holiday Closures

Harnett County Offices will be closed on the following dates. Read more

Related LinksView All

Social Media Pages

View Harnett County Social Media Hub accounts for various Harnett County Departments. Read more

Social Media Policy

To address the fast-changing landscape of the Internet and the way residents communicate and obtain information online, Harnett County departments may consider using social media tools to reach a broader audience. … Read more

Request-a-Speaker

Interested in learning more about Harnett County government initiatives, projects, programs, services, and more? The Request A Speaker program provides a community engagement opportunity where citizens and community organizations can coordinate … Read more

BOC Recap Videos

Our Board of Commissioner Recap Videos are a short summary highlighting the Board's Regular Meetings and what occurred. Read more

FAQsView All

The Public Information Office sends out monthly electronic newsletters the first week of each month. Please subscribe by clicking here and news will be sent directly to your email.

Harnett County has a Facebook, Instagram, Twitter, LinkedIn, and Next-Door Account. Please view our social media hub to view the accounts for the various Harnett County departments.

Please click here to view the 2023 Harnett County holiday schedule.

Please contact the School Bus Safety Program at 877-504-7080 regarding any citation questions.

Harnett County provides various opportunities for individuals to get involved and volunteer.

Some of the volunteer opportunities include:

- Meals on Wheels

- Animal Services

- Department on Aging

- Master Gardener

Please contact individual departments to see what volunteer opportunities they have.

For external volunteer opportunities, visit VolunteerMatch