Welcome to the Harnett County Tax Department

Our departmental goal is to provide fair and equitable tax administration across the County while educating and informing the public of the requirements that govern the tax department. The dedicated staff in the tax department is eager to provide excellent customer service to meet the needs of our citizens.

- Christine Wallace, Tax Administrator

Popular Resources

View AllSearch and Pay Tax Bill

CLICK HERE TO PAY ONLINE To pay your tax on-line your web browser must support 128-bit SSL (Secure Sockets Layer) encryption. Browsers that are … Read more

Tax Foreclosures

Tax Foreclosure Sale Procedures North Carolina law provides Cities and Counties two different methods to enforce tax liens and sell real property for the collection of delinquent ad … Read more

Change My Mailing Address

Mailing address updates can be submitted for real estate, business and personal property by submitting the form below. For registered motor vehicles, address changes should be made here with the North … Read more

Registered Motor Vehicle Request for Assessors Review (Value Appeal)

Registered Motor Vehicles are valued by year, make and model and based on the retail level of trade for property tax purposes. A motor vehicle offered for sale by a dealer … Read more

Exemptions / Exclusions

To obtain information on the various exemptions and exclusions or to apply online, click on the links below. Please note that some applications require additional documentation to be submitted as an … Read more

Present Use Value (PUV) Program (Farm Deferment)

Present Use Value Forms: Form AV-3 Voluntary Payment of Deferred Taxes Without Requesting Disqualification Form AV-4 Use Value Assessment & Taxation of Agricultural, Horticultural, and Forestlands Form AV-5 … Read more

What's New?

View AllPersonal Property Mobile Home Reassessment 2026

Personal Property Mobile Home Reassessment 2026 Prior to the 2026 real property revaluation, the Tax Department noticed a need for process improvements for personal property mobile homes appraisal to … Read more

2026 Personal Property Listing

Personal property is required to be listed with the Harnett County Tax Department beginning on January 1 of each year. The items that are required to be listed are as follows: … Read more

Business Personal Property Tax Essentials Presentation

Attached is the presentation given to business owners, managers, accountants, and others during public meetings at the Harnett Resource and Library Building on December 1st, 2025 and December 15th, 2025. This … Read more

Aircraft Property Tax Essentials Presentation

Attached is the presentation given to aircraft owners during public meetings at the Harnett Regional Jetport on December 3rd, 2024. This presentation has valuable information concerning personal property tax listing, assessment … Read more

Related Links

View AllFAQs

View AllBeginning with renewal notices mailed in July 2013 and due in September 2013, your registration renewal and property tax will be due the same month each year. The NC DMV will send a new combined notice that includes both the vehicle registration fee and property taxes. You will not be permitted to renew your tag without paying all taxes owed on the vehicle.

Contact the NC DMV:

If you received your tax & registration renewal notice and have the following questions/concerns:

- Questions regarding the registration fee shown the notice

- If you moved and the taxing county on the notice is incorrect

- If the vehicle listed on the notice is incorrect

- If the license plate listed on the notice is incorrect

Please reach out to North Carolina Department of Motor Vehicles. You can also check the MyDMV portal to obtain a statement of property taxes paid at the time of registration

Contact the Harnett County Tax Department:

If you received your tax & registration renewal notice and have the following questions/concerns:

- To appeal the vehicle's value

- If the vehicle was registered in Harnett County last year but has moved to a new taxing jurisdiction within Harnett County that is not reflected on the notice

- If you are active-duty military and your home of record is not North Carolina.

- Note: If you no longer own the vehicle and surrendered the license plate to the NC DMV you may disregard the notice. If you still own the vehicle and plan to keep it as an unregistered motor vehicle you are responsible for listing it as of January 1st for property tax purposes.

Please reach out to Harnett County Tax Department.

Registered Motor Vehicle Value Appeal

Registered Motor Vehicles are valued by year, make and model and based on the retail level of trade for property tax purposes. A motor vehicle offered for sale by a dealer to the end consumer represents the best example of the retail level of trade. Values are not adjusted based on wholesale, trade-in, blue book, or private party asking prices.

Appeals must be filed within 30 days of the date taxes are due. To file an appeal, submit a request for assessor's review form, including any supporting documentation that will assist us in reviewing the appeal. Should an assessor’s conference need to be scheduled the appellant will be advised within 30 days of the appeal submission.

Registered Motor Vehicle Request for Assessor's Review Form (Online Appeal Form)

Registered Motor Vehicle Request for Assessor's Review Form (Printable Appeal Form)

Military Vehicle Tax Exemption

Non-Resident Active Duty Military

Active duty, non-resident military personnel may be exempt from personal property taxes in North Carolina. To apply, please submit your most recent Leave & Earnings Statement (LES). The LES must contain the ETS date. You may email your LES to military@harnett.org. When sending your request for exemption, please provide your Tag # and/or a copy of your tax bill.

Military personnel are not exempt from property taxes on leased vehicles. Leased vehicles are owned by the leasing company and not the lessee. The lease companies are a business entity and cannot claim your exemption.

Military Spouse Residence Relief Act

The Military Spouses Residency Relief Act of 2009 amended the Servicemembers Civil Relief Act to provide that a servicemember’s spouse shall neither lose nor acquire a residence or domicile in a state when the spouse is present in the state solely to be with the servicemember in compliance with the servicemember’s military orders if the residence or domicile is the same for both the servicemember and the spouse. This posting will provide information and guidance to local tax offices to assist in their administration of Public Law 111-97. Please click here for the full Military Spouses Residency Relief Act of 2009.

Other dependents are NOT exempt. Real property and business personal property are NOT exempt. Other personal property, such as mobile homes, may qualify for the exemption. You may remit the same documentation as stated above for consideration.

Gap billing of property taxes occurs when there are one or more months (a gap) in billed property taxes between the expiration of a vehicle’s registration and the renewal of that registration or the issuance of a new registration. The vehicle is an unregistered vehicle during the lapse in registration but is still liable for property taxes during this time. Therefore, it is the responsibility of Harnett County Tax Department to assess and bill for the missed months of taxation during the gap in registration.

Property taxes paid to the North Carolina Division of Motor Vehicles (NCDMV) at the time of registration renewal, or new issuance, are for the same 12-month period as your registration. The taxes billed on a gap property tax notice are only for the months your vehicle was not registered with the NCDMV.

Gap tax bills can not be paid at NCDMV as they are billed and collected by the Harnett County Tax Department. You can click here to search outstanding tax bills including unregistered motor vehicle bills.

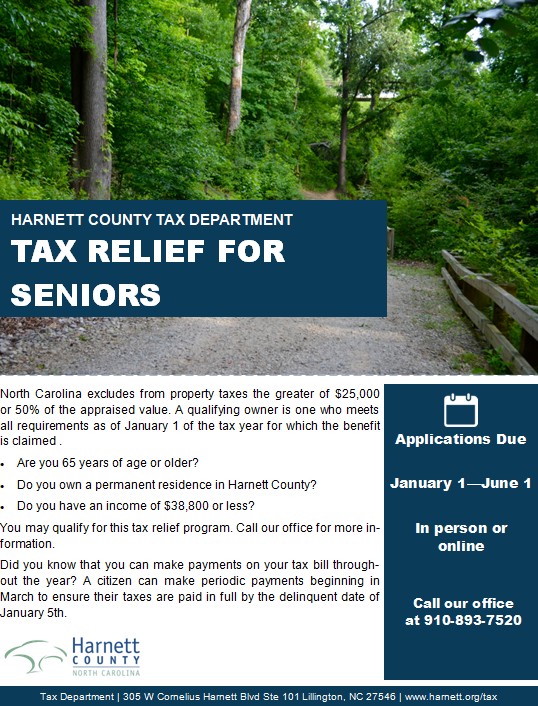

To obtain information on the various exemptions and exclusions or to apply online, visit our exemptions and exclusions page (click here).

Note all exemptions must be applied for and are not automatically granted. Deadlines for applications are listed on the linked page.

Personal property is required to be listed with the Harnett County Tax Department beginning on January 1 of each year. The items that are required to be listed are as follows:

Individual Personal Property - watercraft, aircraft (See aircraft reassessment information here), unlicensed motor vehicles, mobile homes (double-wide mobile homes are listed as real estate if it is located on the homeowners land).

Business Personal Property - items such as machinery, equipment, farm equipment (including poultry and hog house equipment), furniture and fixtures, computers, leasehold improvements, IRP tagged vehicles, and supplies that are used in connection with a business or used for the production of income.

The deadline to list these items is January 31st. If January 31st falls on a weekend the listing period is extended to the first working day of February. A 10% late listing penalty will be charged if property is not listed within the listing period. Not receiving a listing form is not a valid reason for releasing a late listing penalty.

For new residents of Harnett County who have personal property that is required to be listed you will need to call or stop by our office to request a listing form. Once you have listed the property the first year, you will then be on our mailing list and we will automatically mail you a form each year for your review.

Individual Personal Property Listing Form (blank form)

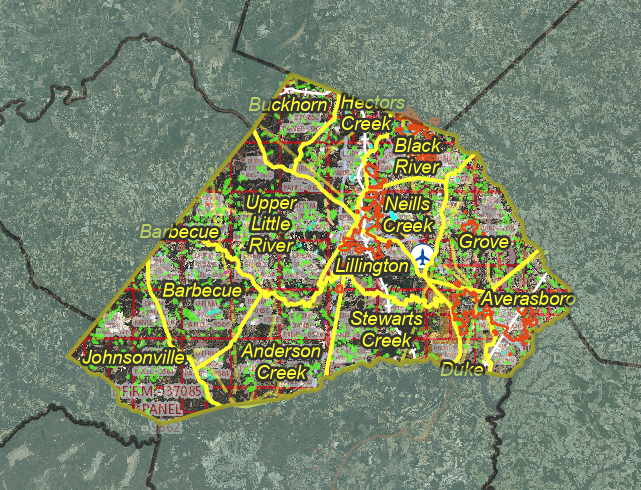

Real property includes land and improvements on the land such as: houses, double-wide mobile homes (double-wide mobile homes are listed as real estate if it is located on the homeowners land), carports, garages, sheds, poultry houses, swine houses, swimming pools, etc.

To search our real property data and bills can be searched via our online public access site (click here)

There is also real property information available via the GIS Viewer (click here)

For information on how to format the parcel number for searching this systems see attached document.

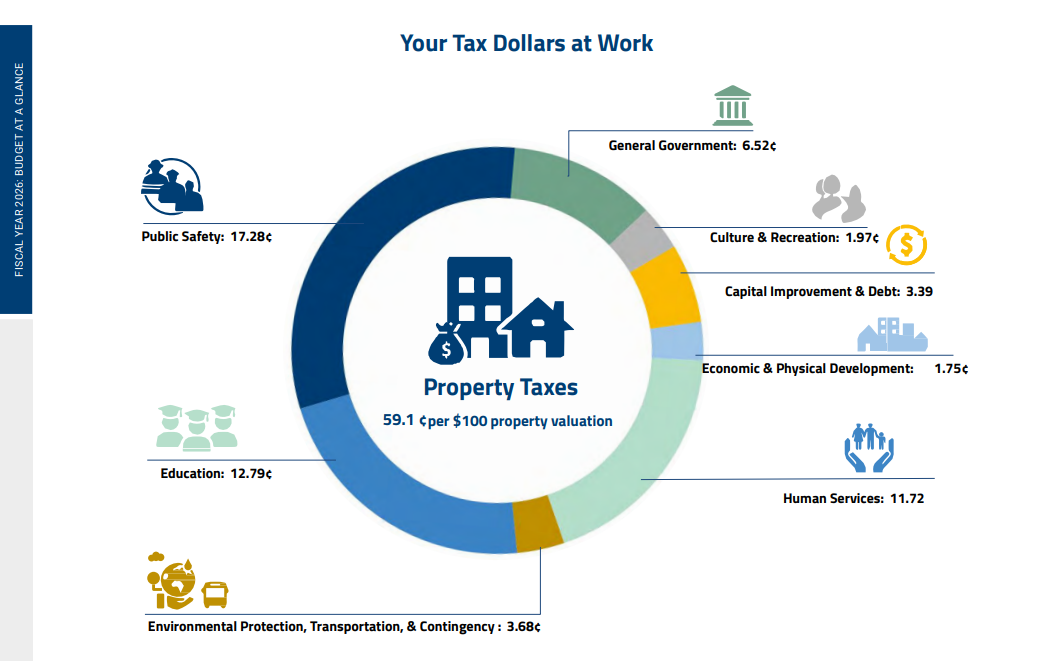

Annual property taxes on real and personal property (excluding registered DMV bills) are due September 1st and must be paid by January 5th of the following year. Interest is charged at the rate of 2% January 6th and ¾% each month thereafter.

To search the public access tax bills for paid and unpaid tax bills click here.

Payment Options

Pay Online:

CLICK HERE TO PAY ONLINE

To pay your tax on-line your web browser must support 128-bit SSL (Secure Sockets Layer) encryption. Browsers that are currently supported are, Netscape, Microsoft Internet Explorer 4.0 or above, and Firefox 1.0 and above. Additional browsers may work, but have not been tested.

If you are not using a supported browser, or would prefer to pay your tax bill using a touch-tone phone, call 1-866-580-9996.

How does the system work?

You will be asked to enter the bill number or abstract number printed on your bill. Once entered, the system will gather information about your bill from the county tax system. The amount you owe will be displayed. Depending on your bill, you may be given the option to pay only a portion of the total amount due. Once you enter or accept the payment amount, the system will calculate the convenience fee and display it. The total payment amount, including the fee, must be approved before the system will continue. If you choose not to pay the fee, the entire transaction is canceled and no further action is taken.

Successful payments are updated on the county tax system immediately. If payment was for a DMV bill, any blocks will be removed from the NCDOT DMV system allowing the taxpayer to purchase their vehicle plates.

* On rare occasions, the county tax system, and/or the NCDOT DMV system connection is not available, and updates are delayed.

Safe and Secure - CCPaymentService, in cooperation with Harnett County, uses the latest encryption technology, is certified by the Credit Card Association, and adheres to all government regulations. Payment over the Internet or phone is convenient, safe, and secure.

Pay In Person or By Mail:

Remit payment to: 305 W. Cornelius Harnett Blvd Ste 101, Lillington, NC 27546

Prepayments to tax bills are accepted between February and August. This is to help lessen the one time cost to the taxpayer. Once property taxes are billed, usually in August, the taxpayer may wish to divide the bill by the number of months remaining in the year and pay monthly installments. This may help to have the bill paid in full by January 5th.

Please note that interest begins January 6th and once the tax bill is delinquent, our office DOES NOT make payment arrangements.

The advertisement of tax liens on real property takes place in or after March of each year. An advertisement fee is added to the bill and the property is required to be advertised in the name of the owner as of January 6th.

If the Tax Department receives a NSF check, payment would be immediately voided correcting the tax department records. An amount of 10% of the check or an amount of $25.00, whichever is greater will be applied to the bill.

Harnett County does not offer a discount on Ad Valorem property taxes. However, there are Exemption and Exclusion programs that may benefit certain citizens. Please click on the link for more information.

When you pay by Credit Card, Debit Card or ECheck:

N.C.G.S. 105-357(b) states that the tax collector may add a fee to offset the service charge the county pays for electronic payments. The convenience fees for these transactions are listed below and are paid to CCPaymentService, the payment processing service, not to Harnett County. The amount of the fee and total amount to be charged will be disclosed to you prior to you providing your credit card information and submitting the final payment.

PERSONAL DEBIT CARDS - $3.80 PER TRANSACTION

CREDIT CARDS – 2.50% OF BALANCE OWING

BUSINESS CREDIT/DEBIT CARDS, HIGH REWARDS – 3.25%

ECHECKS- $2.00 PER TRANSACTION